Christmas and New Year’s is a time of reflection for many, including me. It’s a time to return to our core goals, our purpose, and compare it with what we’ve achieved so far. It’s an important thought process to check whether we’re on track to achieving our goals, our purpose.

It’s not always easy to figure out on our own how to better align our actions with our purpose, how to achieve more, how to have a bigger social impact. From my experience, I can only go so far with my own ideas and thoughts. At some point, it’s other people’s perspectives that make the best goals and actions become clear to me.

So, I thought I’d try something collaborative with this blog and invite you to take part.

Here’s the idea: We each share a brief social impact statement (share our purpose), one recent social impact achievement (celebrate one of our successes), and one social impact pledge (commit to one thing we could do better/more of). You can of course do this more comprehensively for yourselves, but for this exercise, let’s keep it simple. In turn, others are encouraged (but not obliged) to comment on previous contributions – e.g. by making a suggestion towards achieving someone else’s pledge.

The benefit of the exercise would be two-fold:

- It’s a simple opportunity to help you reflect on your social impact and produce actionable goals for yourselves towards increasing your social impact.

- You are inspired by other people’s achievements, get useful tips from others, and share some of your own know-how with your colleagues in the sector.

Two recent clients of mine, The Scout Association and Future First, and me will get the ball rolling:

SocStats

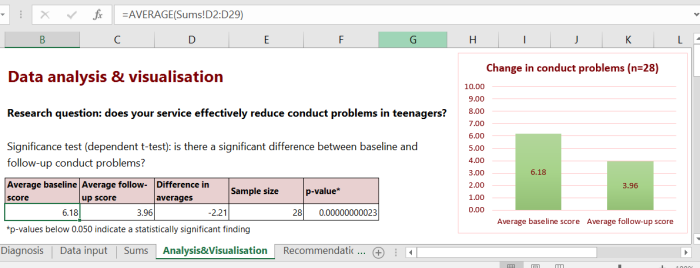

Purpose: I want to empower social sector organisations to make better use of data to maintain and increase their social impact.

Achievement: I helped one of my clients figure out what the key attributes of a great boss are based on data from a qualitative survey.

Pledge: I want to further improve my reporting style so that data insights are more easily digestible and feel directly actionable to my clients.

The Scout Association

Purpose: Actively engage and support young people in their personal development, empowering them to make a positive contribution to society

Achievement: With the help of SocStats, we completed our pilot into impact measurement within Scouting, no easy thing when you are a volunteer led, federated, non-time bound intervention.

Pledge: We’ll now take our learning and undertake impact measurement annually, constantly seeking to become more robust so that we can improve our practice, prove our impact and make better decisions as a Movement.

Future First

Purpose: I want to ensure all young people have access to role models they can relate to.

Achievement: I used data from a feedback survey together with usage data from our online tool to make a series of improvements to this system to drive up its usage and mean more young people have access to role models.

Pledge: I want to put in place longer term outcome measurement.

We look forward to your contributions! Please make sure to include your organisation’s name when you leave a comment/reply below.